(i) Accounting Treatment for Unrecorded Assets Unrecorded asset is an asset, which have not been shown in the books of account or which has been written *** in the books of accounts, but the asset is still available in physical condition. Sometimes it is sold outside for cash and sometimes it is taken away by the partner.

The accounting treatment for unrecorded asset will be there according to the situation.

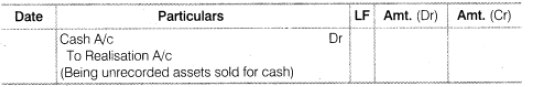

(a) When the unrecorded asset is sold for cash the following Journal Entry will be there

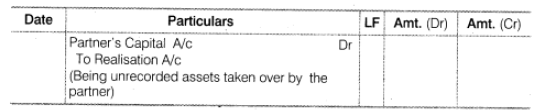

(b) When the unrecorded asset is taken over by any partner the following Journal Entry will be there

(ii) Accounting Treatment for Unrecorded Liabilities Unrecorded liabilities are those liabilities, which have not been shown in the books of account. But at the time of dissolution they are required to be paid ***. The following Journal Entry will be there as per situation.

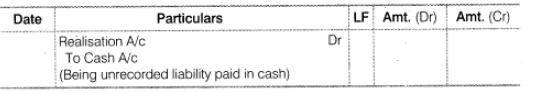

(a) When the unrecorded liability is paid *** the following Journal Entry will be there

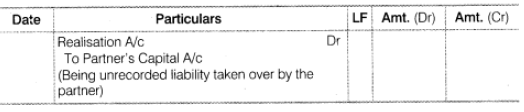

(b) When the unrecorded liability is taken over by a partner. The following Journal Entry will be there