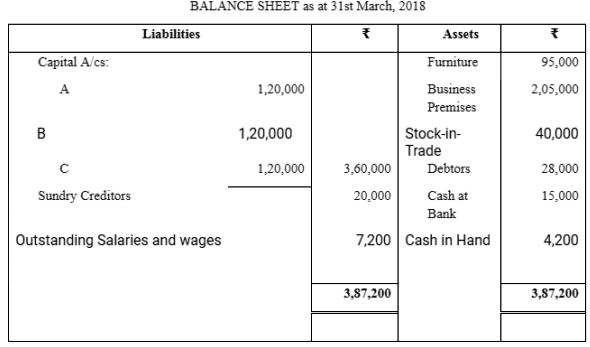

Following is the Balance Sheet of the firm, Ashirvad, owned by A, B and C who share profits and losses of the business in the ratio of 3 : 2 : 1.

On 1st April, 2018, they admit D as a partner on the following conditions:

(a) D will bring in Rs.1,20,000 as his capital and also Rs. 30,000 as goodwill premium for a quarter of the share in the future profits/losses of the firm.

(b) The values of the fixed assets of the firm will be increased by 10% before the admission of D.

(c) Mohan, an old customer whose account was written *** as bad debts , has promised to pay Rs. 3,000 in full settlement of his dues.

(d) The future profits and losses of the firm will be shared equally by all the partners. Pass the necessary journal entries and Prepare Revaluation Account, Partners Capital Accounts and opening Balance Sheet of the new firm. Note: There will be no entry for the promise made by Mohan, since it is an event and not a transaction. There is another view, Rs. 3,000 is to be considered as bad debts recovered. In this situation result will be as follows: Gain( Profit) on Revaluation – Rs. 36,000; Capital A/c’*: A – Rs. 1,66,000; B – Rs 1,42,000; C – Rs. 1,16,000; D – Rs. 1,20,000; Balance Sheet Total – Rs. 5,72,000.