Vikas, Gagan and Momita were partners in a firm sharing profits in the ratio of 2 : 2 : 1. The firm closes its books on 31st March every year. On 30th September, 2014 Momita . According to the provisions of Partnership Deed the legal representatives of a deceased partner are entitled for the following in the event of his/her *:

(a) Capital as per the last Balance Sheet.

(b) Interest on capital at 6% per annum till the date of her *****.

(c) Her share of profit to the date of ***** calculated on the basis of average profit of last four years.

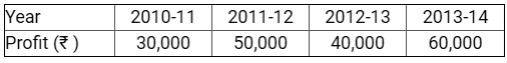

(d) Her share of goodwill to be determined on the basis of three years purchase of the average profit of last four years. The profits of last four years were:

The balance in Momita’ Capital Account on 13st March, 2014 was Rs 60,000 and she had withdrawn Rs. 10,000 till date of her ***. Interest on her drawings was Rs. 300. Prepare Momita’ Capital Account to be presented to her executors.