Note:

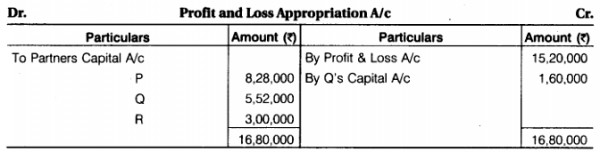

(1) Q guaranteed to earn minimum Rs 4,80,000. But he earn only Rs 3,20,000.

So, balance Rs 1,60,000 is charged from his capital account.

(2) Total profit of firm = 15,20,000 + 1,60,000 = Rs 16,80,000

R guaranteed by firm for 3,00,000 profit.

So, Balance profit 16,80,000 – 3,00,000 = Rs 13,80,000 will distributed between P and Q in 3:2 ratio.