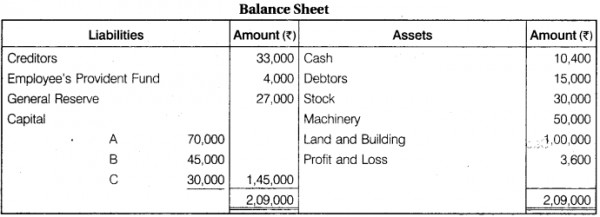

A, B and C are partners, sharing profits in the ratio of 4 : 3 : 2. Their balance sheet on 31st March, 2017 was as follows :

The firm had a ***** life insurance policy for Rs 40,000. The surrender value of the policy was Rs 13,500 as on 31st March, 2017.

B retires on the above date on the following conditions :

(a) Land and building are undervalued by Rs 20,000.

(b) Goodwill is to be valued at Rs 18,000.

(c) A provision for doubtful debts of 5% is to be created and machinery be written down by 10% and stock by 5%.

(d) A provision of Rs 1,500 be made in respect of legal charges,

(e) ***** life policy will appear in balance sheet. B to be paid Rs 5,000 and balance be transferred to his loan account.

Prepare Revaluation account, Partners’ Capital account and Balance Sheet of A and C.