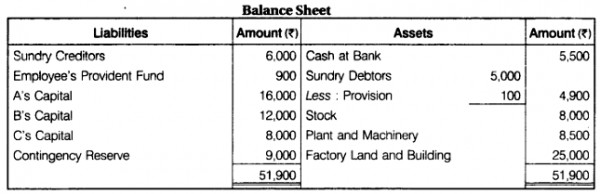

The Balance sheet of A, B and C who were sharing profits in proportion of their capital, stood as follows on 31st March, 2017 :

B retires and the following adjustment of the assets and liabilities have been agreed upon before the ascertainment of the amount payable by the firm to B :

B retires and the following adjustment of the assets and liabilities have been agreed upon before the ascertainment of the amount payable by the firm to B :

(a) That the stock be depreciated by 6%.

(b) That the provision for doubtful debts be brought upto 5% on debtors,

(c) That the factory land and building be appreciated by 20%.

(d) That a provision of Rs 770 be made in respect of outstanding legal charges,

(e) That the goodwill of the entire firm be fixed as Rs 10,800 and B’ share of the same be adjusted into the account of A and C who are going to share in future in the proportion of 5/8 : 3/8 (No goodwill account is to be raised).

(f) That the entire capital of the firm as newly constituted be fixed at Rs 28,000 between A and C in the proportion of 5/8 : 3/8 after passing entries in their account for adjustment (i.e., actual cash to be paid ** or to be brought in by the continuing partners as the case may be).

Pass the necessary journal entries to give effect to the above arrangement and prepare the Balance Sheet of A and C after transferring the amount due to B to separate loan account in his name.