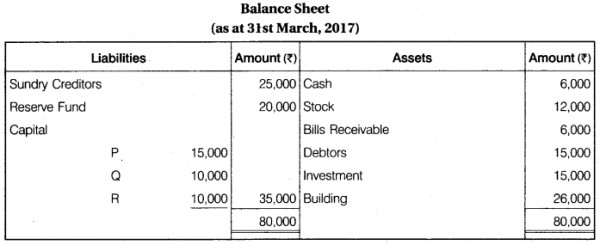

P, Q and R were partners in a firm. Their Balance sheet as at 31st March, 2017 was as follows :

The partnership deed provides that the profit be shared in the ratio 2:1:1 and that in the event ***** the partner, his executors will be entitled to be paid out:

- The capital to his credit at the date of balance sheet,

- His proportion of reserve at the date of balance sheet,

- His proportion of profits of the last 3 years plus 10% and

- By way goodwill, his proportion of the total profit for the three preceding years.

- Share in profit on revaluation of building which is Rs 4,000.

- The net profit of last 3 years are Rs 15,000, Rs 16,000 and Rs 17,000.

R on 30th June, 2017. He had withdrawn Rs 5,000 upto the date of his . The investment were sold at par and R’ executors were paid **. Prepare Partners’ Capital Account, R’ Executor’* Account and Balance Sheet of surviving partners P and Q.