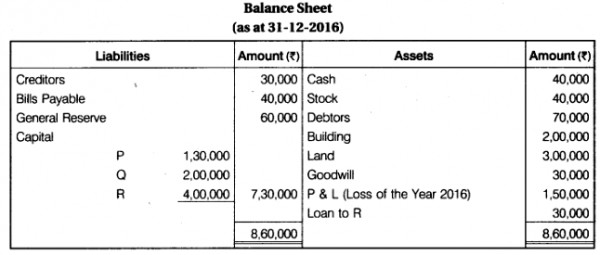

P, Q and R were partners in a firm sharing profits in the ratio 3:2:1. Their balance sheet on 31-12-2016 was as follows :

R on 14-03-2017. The partnership deed provided for the following on the * of a partner.

R on 14-03-2017. The partnership deed provided for the following on the * of a partner.

(i) Goodwill of the firm was to valued at 3 years’ purchase at the average profit of last 5 years.

| Year | 2015 | 2014 | 2013 | 2012 |

| Profit(Rs) | 70,000 | 80,000 | 1,10,000 | 2,20,000 |

(ii) R’ share of profit or loss till the date of his was to be calculated on the basis of the profits or loss for the year ending on 31-12-2016. You are required to calculate the followings :

(a) Goodwill of the firm and R’ share of goodwill at the time of his .

(b) R’ share in the profit or loss of the firm till the date of his .

Prepare R’ Capital account at the time of his to be presented to his executors.