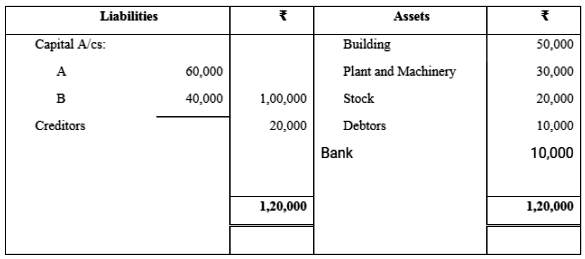

A and B are partners in a firm sharing profits in the ratio of 3 : 2. They admit C as a partner on 1st April, 2018 on which date the Balance Sheet of the firm was:

You are required to prepare the Revaluation Account, Partners Capital Accounts and Balance Sheet of the new firm after considering the following:

(a) C brings in Rs. 30,000 as capital for 1/4th share. He also brings Rs. 10,000 for his share of goodwill.

(b) Part of the Stock which had been included at cost of Rs. 2,000 had been badly damaged in storage and could only expect to realise Rs. 400.

(c) Bank Charges had been overlooked and amounted to Rs. 200 for the year 2017-18.

(d) Depreciation on Building of Rs. 3,000 had been omitted for the year 2017-18.

(e) A credit for goods for Rs. 800 had been omitted from both purchases and creditors although the goods had been correctly included in Stock.

(f) An expense of Rs. 1,200 for insurance premium was debited in the Profit and Loss Account of 2017-18 but Rs. 600 of this are related to the ** after 31st March, 2018.