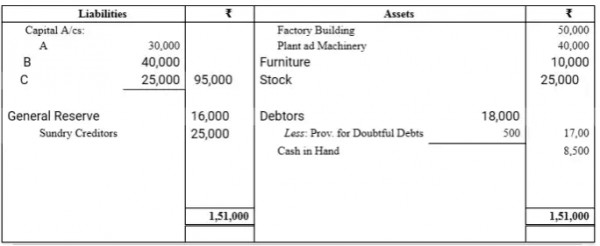

A, B and C are partners in a firm, sharing profits and losses as A 1/3, B 1/2 and C 1/6 respectively. The Balance Sheet of the firm as at 31st March, 2018 was:

C retires on 1st April, 2018 subject to the following adjustments:

(a) Goodwill of the firm be valued at Rs. 24,000. C’* share of goodwill be adjusted into the account of A and B who are going to share in future in the ratio of 3 : 2.

(b) Plant and Machinery to be depreciated by 10% and Furniture by 5%.

(c) Stock to be appreciated by 15% and Factory Building by 10%.

(d) Provision for Doubtful Debts to be raised to Rs. 2,000. You are required to pass journal entries to record the above transactions in the books of the firm and show the Profit and Loss Adjustment Account, Capital Account of C and the Balance Sheet of the firm after C’* retirement.