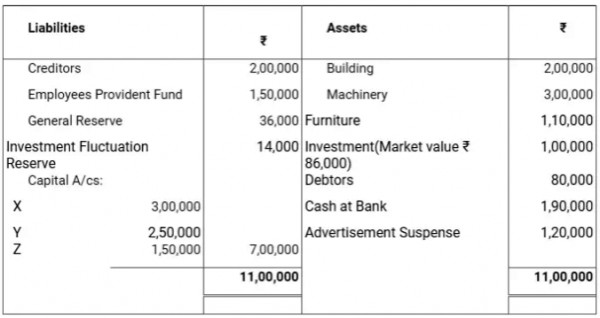

X, Y and Z were partners in a firm sharing profits and losses in the 5 : 4 : 3. Their Balance Sheet on 31st March, 2018 was as follows:

X **** on 1st October, 2018 and Y and Z decide to share future profits in the ratio of 7 : 5. It was agreed between his executors and the remaining partners that:

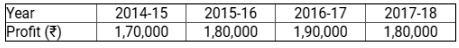

(i) Goodwill of the firm be valued at 2 years purchase of average of four completed years profit which were:

(ii) X’ share of profit from the closure of last accounting year till date of **** be calculated on the basis of last years profit.

(iii) Building undervalued by Rs. 2,00,000; Machinery overvalued by Rs.1,50,000 and Furniture overvalued by Rs. 46,000.

(iv) A provision of 5% be created on Debtors for Doubtful Debts.

(v) Interest on Capital be provided at 10% p.a.

(vi) Half of the net amount payable to X’ executor was paid immediately and the balance was transferred to his loan account which was to be paid later. Prepare Revaluation Account, X’ Capital Account and X’* Executors Account as on 1st October, 2018.